What are operating expenses?

The operating expenses (OPEX) are the costs that a business incurs in running its operations. The company must invest these resources to execute its activities.

Operating expenses usually include rent, marketing costs, inventory costs, payroll, equipment, insurance, costs of research and development, and software licensing fees.

Increase of Operating Expenses

An increase in the operating expenses implies that the company is profiting less. Most companies are careful with their operating expenses because they are less fixed than non-operating expenses. Therefore, to cut down the OPEX, the company may request the staff to work from home or implement other money-saving techniques.

What is Non-Operating Cost?

Non-operating expenses are costs that are unrelated to the business operations. In most cases, the non-operating expenses are interest charges, the cost of borrowing, or losses incurred upon the disposal of the asset.

Non-operating expenses are not included when computing the financial performance of the business.

What is a Capital Expense?

Capital Expense (CAPEX) is a cost that involves acquiring or upgrading the capital assets such as equipment, plant, or property. Unlike OPEX, CAPEX can be capitalized for taxation purposes.

What is the Operating Expense Ratio?

The operating expense ratio (OER) is the cost incurred in running the property against the income the property generates. The OER concept is commonly used in real estate for companies that run rental units. Low OER is an indication that the company is spending less on operating expenses from the income.

Also, businesses can use the OER to evaluate the operating expenses of two similar ventures. For instance, a company that runs two similar ventures can compare them, so if one venture has 15% OER more than the other, it can start investigating why there is a disparity.

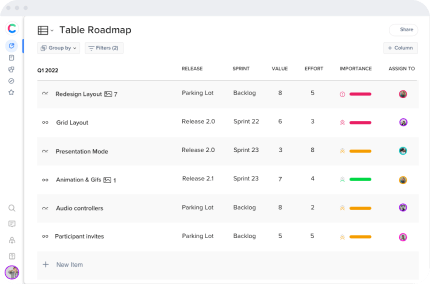

How to Determine Operating Expenses?

The operating expenses of a company are summarized on its income statement. The operational costs differ depending on the setup or the industry. To determine your company’s operating expenses, check the general ledger and analyze the expenses that do not directly add to the cost of creating the product.

Benefits of Operating Costs to a Company

The operating expenses enable a company to access its cost and stock management efficiency. OPEX highlights the level of expenditure the company requires to generate revenue or run its affairs.

Where a company is incurring high OPEX in the percentage of sales compared to its competitors, it indicates that it is less efficient in generating the sales.

OPEX is significant in horizontal analysis because it reflects the company’s current and past performance.

The downside of using OPEX is that it is an absolute number and not a ratio. It poses challenges because you cannot use it as a metric for comparing firms in the same industry.

Conclusion

The operational expenses reflect the costs of operational activities of a company rather than its financing and investment activities. The operational activities of a company are necessary for generating revenue. Every company should find ways of reducing operating expenses without compromising the ability of the company to compete with its competitors.